Comments:"Google Search Terms Can Predict the Stock Market | Surprising Science"

URL:http://blogs.smithsonianmag.com/science/2013/04/google-search-terms-can-predict-the-stock-market/

An investing strategy based on the frequency of certain words Google searches, it turns out, might provide sizable profits. Image via Flickr user velorowdy

Google, as many researchers know well, is more than a search engine—it’s a remarkably comprehensive barometer of public opinion and the state of the world at any given time. By using Google Trends, which tracks the frequency particular search terms are entered into Google over time, scientists have found seasonal patterns, for example, in searches for information about mental illnesses and detected a link between searching behavior and a country’s GDP.

A number of people have also had the idea to use these trends to try achieving a more basic desire: making money. Severalstudies in recent years have looked at the number of times investors searched for particular stock names and symbols and created relatively successful investing strategies based on this data.

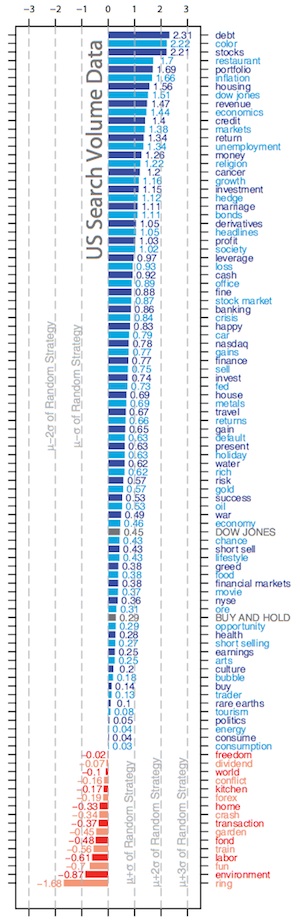

A new study published today in Scientific Reports by a team of British researchers, though, harnesses Google Trends data to produce investing strategies in a more nuanced way. Instead of looking at the frequency that the names of stocks or companies were searched, they analyzed a broad range of 98 commonly used words—everything from “unemployment” to “marriage” to “car” to “water”—and simulated investing strategies based on week-by-week changes in the frequencies of each of these words as search terms by American internet users.

A listing of the 98 words used in the study, from most effective at predicting market declines (debt) to least effective (ring). Image via Scientific Reports/Preis et. al.

The changes in the frequency of some of these words, it turns out, are very useful predictors of whether the market as a whole—in this case, the Dow Jones Industrial Average—will go down or up (the Dow is a broad index commonly considered a benchmark of the overall performance of the U.S. stock market).

The strategy was relatively straightforward: The system tracked whether a word such as “debt” increased in search frequency or decreased in search frequency from one week to the next. If the term was suddenly searched much less frequently, the investment simulation bought all the stocks of the Dow on the first Monday afterward, then sold all the stocks one week later, essentially betting that the overall market would rise in value.

If a term such as “debt” was suddenly searched much more frequently, the simulation did the opposite: It bought a “short” position in the Dow, selling all its stocks on the first Monday and then buying them all a week later. The concept of a “short” position like this might seem a bit confusing to some, but the basic thing to remember is that it’s the exact opposite of conventionally buying a stock—if you have a “short” position, you make money when the stock goes down in price, and lose money when it goes up. So for any given term, the system predicted that more frequent searches meant the market as a whole would decline, and less frequent searched meant it would rise.

During the period of time studied (2004-2011), making investment choices based on a few of these words in particular would have yielded overall profits several times higher than a conservative investment strategy of simply buying and holding the stocks of the Dow for the entire time. For example, basing a strategy solely on the search frequency of the word “debt,” which turned out to be the single most profitable term in the study, would have generated a profit of 326% over the seven years studied—compared to a profit of just 16% if you owned all the stocks of the Dow for the whole period.

So if you systematically bought a “short” position in the market every time the word “debt” suddenly started getting searched more often, you’d have made a ton of money over the seven years studied. But what about other words? The system simulated how this strategy would have performed for each of 98 words chosen, listed in the chart at right from most useful at predicting the movement of the markets (debt) to least useful (ring). As seen in the chart, for some of these terms the frequency that we type them into Google seems to serve as a very effective early-warning system for declines in the market.

Stock market declines typically reflect investors’ overall belief that, at any given time, it’s better to sell stock than buy it, and they often happen suddenly, when investors move in a herd to a new position—so the researchers speculate that rises in the terms’ frequencies in search convey a nascent feeling of concern about the market, before it’s expressed via actual transactions. All these searches might also reflect countless investors in an information-gathering phase, seeking to find out as much as they possibly can about an industry or a stock before selling it.

Even beyond the practical investment strategies that this type of analysis might generate, simply looking through the words provides a striking—and oftentimes confusing—window into the collective American psyche. It’s seemingly obvious why a sudden increase in the amount of people searching for the word “debt” might signal overall negative feelings about the market, and would likely precede a drop in stock values, and why “fun” might precede increases in the market. But why do searches for the words “color” and “restaurant” predict declines nearly as accurately as “debt”? Why do “labor” and “train” also predict stock market rises?